SPECIAL REPORT: Israeli tech titans ready to bounce back in 2024

Business leaders say the Startup Nation is hoping to harness AI developments after a bleak economic year and emerge from its crisis stronger than ever

Israel’s tech sector – the largest of its economy – has faced a challenging 2023. The war came on top of the judicial reforms crisis, a soft global economy and a tech downturn and left startups struggling. Funding has dipped and the call-up of more than 300,000 reservists has presented staffing issues.

But as we look ahead to this year, several business leaders and investors are offering hope, predicting that the startup nation will emerge from this crisis stronger than ever.

Ben Lazarus, partner and head of consulting PwC Israel, told Jewish News:

“Looking forward a lot depends on the length of the war, but amongst all the bad news there is a sign of hope and that is the clear resilience and sense of unity that has come to Israel – its young generation has proven strong and motivated (and many have come back to fight) and a feeling of unity and common purpose has been set across all sectors of the population. If this continues it could galvanise the economy as and when it lifts out of war and the population gets fully back to business.”

A recent 2023 Exit Report by PwC Israel painted a bleak picture of the Israeli tech industry: the aggregate value of acquisitions and IPOs fell by 56 percent, from $16.8bn in 2022 to $7.5bn in 2023.

Meanwhile, the country’s M&A deal value amounted to $9.8bn, down 46 percent from $18bn in 2022 and foreign investment in Israel fell 41 percent to $6.7bn amid concerns over political and social developments taking place in Israel in 2023, as well as the war.

There is, however, reason to be positive.

AI expert and investor Eze Vidra, the co-founder and managing partner of Remagine Ventures, told Jewish News: “There’s no doubt we’re living through a difficult and complicated period as a country and as the Jewish people in the diaspora, and it of course has an impact on Israel’s tech sector as well. However, I’m optimistic that we’ll start seeing the boom and recovery hopefully from 2024.”

Several Israeli companies have raised money over the past few weeks, signalling signs of a rebound.

They include Dream Security, which completed a $35m financing round, Israeli data security startup Mine’s raising a $30m Series B co-led by PayPal Ventures, Foretellix adding $42m to its series C (bringing the total round to $85m) to provide safety technologies for autonomous driving, and Israeli-founded VAST Data, which develops an AI data platform and secured $118m in Series E funding at a $9.1 billion valuation. On a smaller scale, CorrActions, an Israeli AI-based driver safety startup, raised $7.25m in a Series A round led by Volvo Cars Tech Fund, joined by BlackBerry, and other venture capital firms including OurCrowd, the Jerusalem-based global investment platform for startups and alternative assets.

OurCrowd founder and CEO Jon Medved believes 2024 is set to be a “great vintage” for venture investors.

He told Jewish News: “Company valuations are off their highs, so prices are very attractive as an entry point for investors. We know from past experience that great tech companies, including some of the world’s biggest, are those that can weather periods of stress and disruption and emerge strengthened because they have great technology, business model and management. We see startups continuing to thrive and deliver even in the middle of a war, so that increases our confidence that they will do well when we emerge from this crisis.

“History also shows that after each crisis in the past 25 years, Israel’s economy and its high-tech sector has bounced back and emerged even stronger. I am confident the same will happen this time around. Even now, we see companies achieving exits and attracting significant investment.”

Jonathan Morris is a partner at Bryan Cave Leighton Paisner (BCLP) and co-chair of the firm’s Israel Group. He said: “Israeli entrepreneurs are very resilient and innovative and so, despite companies having 10-20 percent of their employees called up for military service, they are determined for business to continue as close to ‘normal’ as possible.

“And if the war ends in early 2024, with a relatively quick demobilisation of most of the reserves and a period of stability, one can expect a determined effort by them to get out into the market and make up for lost time. That doesn’t mean to say that every company will make it. But I certainly wouldn’t write-off Israel startups either.”

Israel’s cyber security companies had a particularly strong 2023, responsible for around half of all deals done, with an aggregate value of $4.2bn, according to the PwC report.

Among the most prominent was the acquisition of Talon by Palo Alto Networks for a reported $625m – announced in the midst of the war, plus HPE’s purchase of Axis, and Perimeter 81 by Check Point.

PwC Israel partner Yaron Weizenbluth said. “Cyber deals saved the situation, but you have to look at it critically. Out of the 45 deals in 2023, 19 had some connection to cyber, with a cumulative value of $3.8bn, and 51 percent of the total deal value. Another interesting fact is that among the 12 deals with a value of more than $200 million, no less than 10 came from that segment.”

If you further exclude Israel’s two most significant IPOs this year – the beauty tech company Oddity (IL Makiage) and Freightos, the world’s largest freight marketplace – cyber accounted for 100 percent of all deals over $200m.

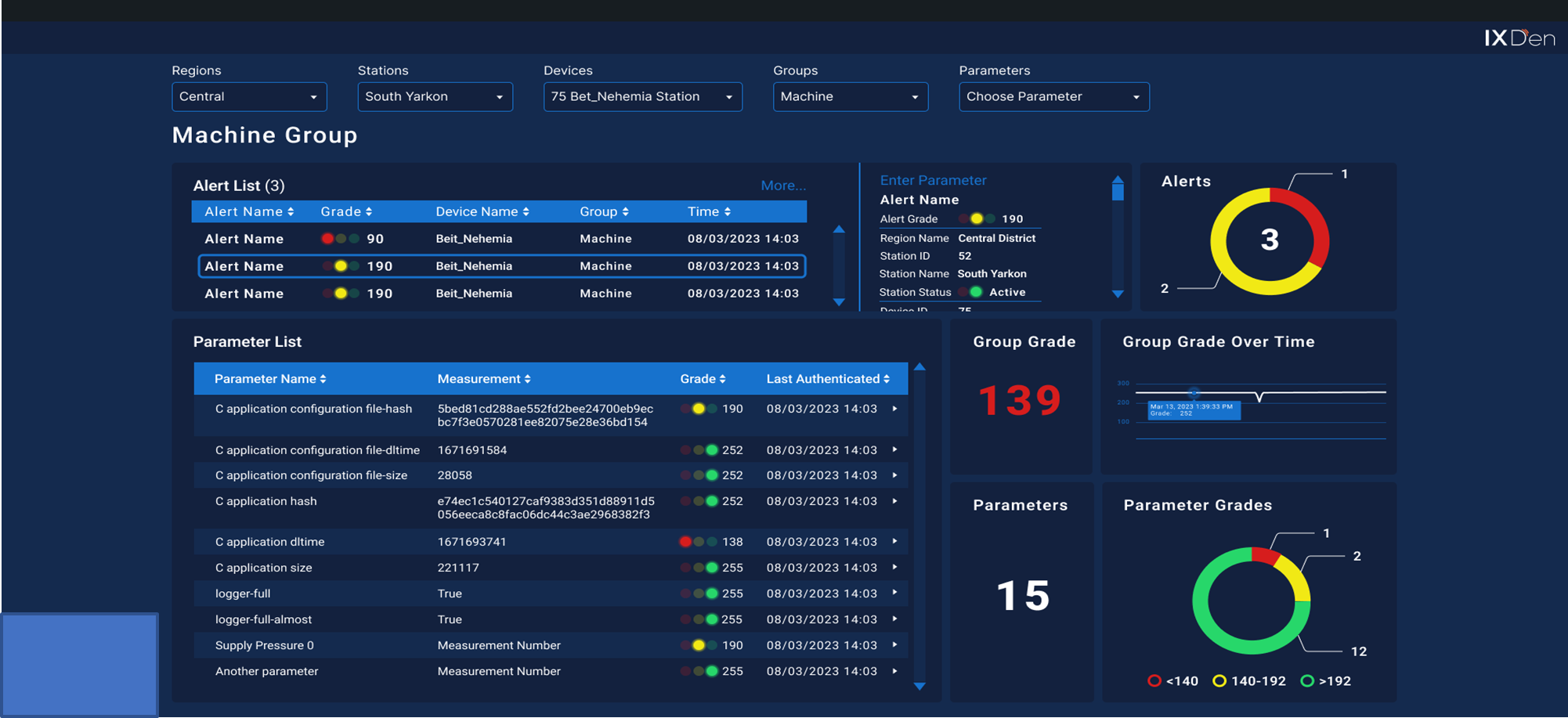

“Israel continues to be a giant in cyber security, with about 40 percent of every dollar invested worldwide in the sector invested in Israel,” added Medved. “And I expect that trend to continue with companies like CyberSixgill and IXDen leading the way.”

Tel Aviv based IXDen has developed an AI platform for securing critical infrastructure such as water, gas, oil and energy, from cyber-attacks. It has secured a contract with Mekorot, the National Water Company of Israel, for the roll out of 3,000 sites across the country. Seventy have been finished and the company plans to complete all 3,000 this year.

IXDen’s chief executive Zion Harel, said: “We are helping companies to secure their operations from any attacks that could come through the sensors.

“Cyber attacks that intentionally damage critical infrastructure operations, which can be a huge loss financially as the attackers can shut down the operation for days.”

IXDen are also working with defence groups but are unable to disclose which ones.

“We are committed to helping Mekorot and other Israeli critical infrastructure organisations in their efforts to secure their operations against any cyber-attacks in this war and in general, helping to maintain the daily life of ordinary citizens”.

2024 will be key for climate tech startups in the face of intensifying global climate challenges. Governments – and investors – across the globe are realising the pressing need for solutions, and tech entrepreneurs are doing their best to provide them. No greater is this more evident than in Israel, which is at the forefront of the innovation.

Last year, a selection of Israeli companies were in London as part of a pioneering climate tech delegation, organised by UK Israel Business, and Climate First, Israel’s leading ClimateTech accelerator founded by Nadav Steinmetz and Guy Cherni. Among them was Criaterra Innovations, which creates low-carbon and sustainable building materials to build office and residential buildings that can be recycled and reused, and Zohar CleanTech, a revolutionary waste management solution that converts unsorted residential waste into clean energy onsite, reducing landfill and GHG emissions.

Speaking at a recent Restart IL business event, Cherni said: “Climate change is the biggest challenge of our generation. Climate tech is the biggest opportunity of our generation” and that Israel is the “best place” to realise this opportunity because: “we’re always facing new challenges, because we always have to deliver in order to survive, because we’re programmed to innovate out of necessity, because we have a track record of innovation, from desert agriculture to advanced defence systems. The climate crisis is no different. We’re on it.”

Israel continues to solidify its position as a key player in the dynamic realm of Generative AI and Yuval Passov, head of Google for Startups Israel believes:

“The latest AI technology will take startups to a new level in 2024.

He told Jewish News: “At the root of any startup is the motivation to solve problems at hand. 2024 will be the year of problem solving based on the current difficulties Israel is facing. During the past three months, the greatest minds have come together to solve big difficulties.

“Cybersecurity and Generative AI will boom in the next year due to the need to solve problems quickly in our current state of affairs.”

Passov said there will also be a need to train more people in AI, which Google for Startups is beginning to do with its Startup School Gen AI programme.

According to Alex Shmulovich, Principal at tech investor Viola Ventures, Israel currently ranks as the third-largest Generative AI venture capital ecosystem in the world, boasting an impressive investment influx of over $2.2 billion in the past three years. Over 130 companies in the country have either secured funding or demonstrated initial signs of traction.

“In AI, Israeli startups are developing specific technology in areas of drug discovery, financial security and agricultural technology,” noted Medved. ”Israel is also an AI leader in developing fundamental tools that other companies can use to integrate AI into their own businesses, with startups like Open AI, Leo AI and next-generation AI chipmakers like Hailo and PolyN. Other sectors where Israel is a major player include health, cloud computing and financial technology.”

Vidra’s Remagine Ventures, which has been investing in generative AI since early 2019, before the term ‘Generative AI’ was even around, has been following the landscape closely. “In the past year alone we’ve seen the number of generative AI startups more than double, and collectively raise over $2.5bn in funding to date,” said Vidra.

He is particularly excited about what 2024 has in store for companies such as HourOne, which offers avatar-led text to video solutions, Munch, using generative AI for video content repurposing, and Playo, which is building deep-learning models for generative AI in gaming. “These early-stage companies are not just riding the wave of technological advancement, but are at the forefront, shaping the future of AI and its applications.

“The talent launching new companies is particularly exciting for us, as we believe Israel will continue to be one of the leading AI hubs globally and new technologies present the ability to automate, reduce costs and look differently at almost every industry vertical, from edtech, commerce or health.”

The development of AI continues to pose a huge opportunity for growth within Israel’s financial sector – one of the largest and most advanced in the world.

“More and more we shall feel the entry of AI technologies into the Fintech arena,” noted Shmuel Ben-Tovim, President, The Israel Fintech Centre.

Ones to watch include Motiv8AI, which is using AI and behavioural science to revolutionise the way enterprises understand and communicate with their customers; SureComp – a market-leading provider of digital trade finance solutions for corporations and financial institutions, and Neema, a highly customisable multi-currency Digital Account with international Visa card for the underserved population.

“Israel’s thriving fintech industry remains resilient, offering ground-breaking solutions that resonate on the global stage. In most cases, it is not dependent on physical delivery to its customers, so even temporary delays in international transport are meaningless. Moreover, unlike in a global crisis, such a Covid, target markets show continued and strong demand.

“Locally, start-up companies, where staff are naturally younger and smaller in number, have a higher percentage of drafted people to military reserve service. Early-stage fundraising is also becoming more challenging, and the government is offering support in the way of quick financing solutions. The large Fintech companies, however, are less affected. Even previously-planned M&A’s are moving on as scheduled.”

In October, the American payment giant Shift4 sealed its acquisition deal with Finaro, the Israeli cross-border payments provider.

Jared Isaacman, CEO of Shift4, said at the time: “With Finaro’s tech centre based in Israel, we realise that this comes during an extremely difficult time for those employees and their loved ones,” Isaacman said. “The ability to work together during these trying times is a testament to the talent and character of everyone on the Finaro team. We are proud to welcome them into our Shift4 family.”

Last month, Pontera, an Israeli-founded fintech startup whose software platform helps financial advisers better manage retirement accounts, announced it had secured $60 million in new funding to expand its research and development operations in Tel Aviv. The startup did not disclose details of its valuation, but is estimated to be worth around $550 million, according to reports.

Pontera plans to expand its R&D operations in Israel in 2024 and recruit more than 50 people for positions in cybersecurity, software engineering, data analysis, and product management. It has already moved to a larger office in Israel and is looking for new office space in the US.

Looking to the rest of this year, Ben-Tovim identified several encouraging trends. “Israeli regulation is promoting significant reforms in areas such as open banking and payments, creating important business opportunities for both established and new companies. One of the positive side effects is that more and more large fintech companies (unicorns) are exploring entry into the local market, which will increase competition and create new benefits for the Israeli consumer, both private and business.”

Israel has built a backbone of thousands of startups that are showing resilience amid the war, and the tech ecosystem continues to offer significant possibilities for investment and collaboration.

“Unfortunately, Israel and the Jewish people are no stranger to setbacks from tragedy,” said Passov. “We are a nation which is far too often exposed to difficulties that we need to overcome. With this reality being one we are used to, also comes with our strength – that from darkness we always emerge stronger, and this time is no different. Israeli startups and founders will emerge stronger than ever. They have no choice but to.”

Thank you for helping to make Jewish News the leading source of news and opinion for the UK Jewish community. Today we're asking for your invaluable help to continue putting our community first in everything we do.

For as little as £5 a month you can help sustain the vital work we do in celebrating and standing up for Jewish life in Britain.

Jewish News holds our community together and keeps us connected. Like a synagogue, it’s where people turn to feel part of something bigger. It also proudly shows the rest of Britain the vibrancy and rich culture of modern Jewish life.

You can make a quick and easy one-off or monthly contribution of £5, £10, £20 or any other sum you’re comfortable with.

100% of your donation will help us continue celebrating our community, in all its dynamic diversity...

Engaging

Being a community platform means so much more than producing a newspaper and website. One of our proudest roles is media partnering with our invaluable charities to amplify the outstanding work they do to help us all.

Celebrating

There’s no shortage of oys in the world but Jewish News takes every opportunity to celebrate the joys too, through projects like Night of Heroes, 40 Under 40 and other compelling countdowns that make the community kvell with pride.

Pioneering

In the first collaboration between media outlets from different faiths, Jewish News worked with British Muslim TV and Church Times to produce a list of young activists leading the way on interfaith understanding.

Campaigning

Royal Mail issued a stamp honouring Holocaust hero Sir Nicholas Winton after a Jewish News campaign attracted more than 100,000 backers. Jewish Newsalso produces special editions of the paper highlighting pressing issues including mental health and Holocaust remembrance.

Easy access

In an age when news is readily accessible, Jewish News provides high-quality content free online and offline, removing any financial barriers to connecting people.

Voice of our community to wider society

The Jewish News team regularly appears on TV, radio and on the pages of the national press to comment on stories about the Jewish community. Easy access to the paper on the streets of London also means Jewish News provides an invaluable window into the community for the country at large.

We hope you agree all this is worth preserving.

- Israeli tech

- Startup Nation

- Israel News

- World News

- entrpreneur

- israel hamas war

- FinTech

- AI

- cybersecurity

- IXDen

- Pontera

- PwC

- HourOne

- Munch

- Motiv8AI

- Shmuel Ben-Tovim

- Jonathan Morris

- Eze Vidra

- Ben Lazarus

- Finaro

- Oddity

- Talon

- CyberSixgill

- Talo Security

- SureComp

- Neema

- Playo

- CyberSixgil

- Axis

- Perimeter81l

- Dream Security

- Mine

- Foretellix

- Vast Data

- CorrActions

- Criaterra Innovations

- Zohar Clean Tech

- Guy Cherni

- Climate First

- Nadav Steinmetz