The app taking the pain out payments for the self-employed

An app called Osu, founded by three Israelis, helps self-employed by automating tasks such as sending and chasing invoices and accepting payments

Three former colleagues have teamed up to launch a revolutionary payment app to help the self-employed run and grow their businesses.

Launched last year by Israelis Noam Nevo and Alon Zion, together with British-Israeli Daniel Scott, Osu is transforming the way the self-employed accept and manage their payments, enabling them maximise their time and earnings.

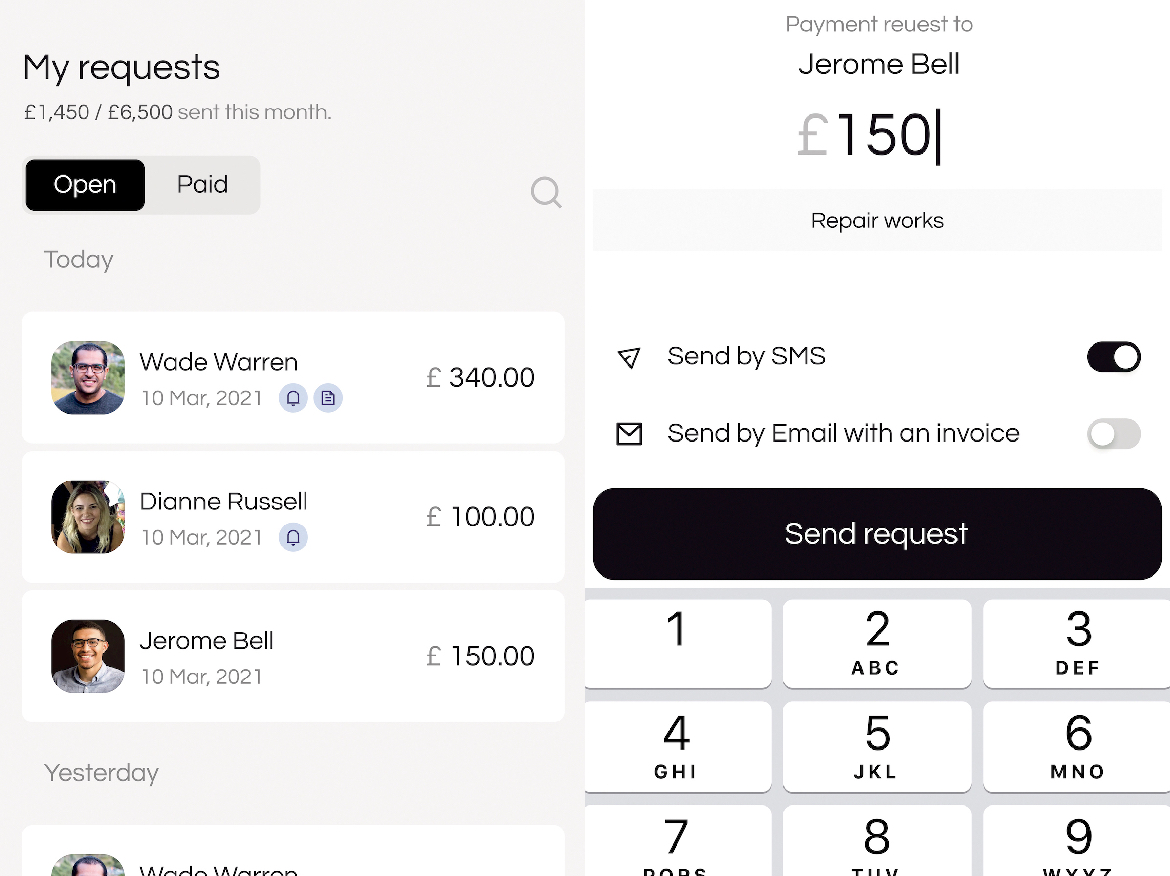

Akin to a virtual PA, the app works behind the scenes to automate tasks such as as sending invoices, accepting payments and chasing customers – the traditional pain points for many.

Get The Jewish News Daily Edition by email and never miss our top stories Free Sign Up

Osu, which means ‘push’ in Japanese, does not charge transaction fees, meaning users get 100 percent of every sale they make and everything is done instantaneously so they aren’t left waiting days to receive their money.

CEO Nevo, a former PayPal tech lead, says: “With more than four million self-employed professionals in the UK – almost half of whom operate entirely alone and cite chasing payments as one of their biggest daily frustrations – we spotted a gap in the market for a payment support app that could simplify the day-to-day hassle of getting paid by customers and eliminate transaction fees. The Osu app allows self-employed professionals to get fully paid, fast.”

This is something Nevo acknowledges is increasingly important at a time when the self-employed are already taking a hit due to the pandemic. And he is not alone in seeing the potential.

The app recently closed a £2.25 million seed round, led by early-stage experts Creandum, backers of Spotify, Kahoot and Klarna, to help it grow ten-fold this year from 1,000 to 10,000 customers. It has also received funding from a series of prolific Angel investors, including Charles Delingpole of ComplyAdvantage, Will Neale of Grabyo and Michael Pennington of Gumtree.

Nevo and Zion – the former finance director of Matomy Media – had worked together as co-founders of a money transfer system for financial institutions, which Scott, a seven-year veteran of The Boston Consulting Group, joined later on. But, aware of the difficulties faced by freelancers when it comes to payments, they saw the need for a streamlined tool focusing solely on the self-employed.

“I understood the importance of tracking and managing finances within a start-up and how losing sight of payments can quickly affect general day-to-day operations,” recalls Nevo. “The constant chasing and management of this process pushed me to create a better approach.”

Subscribers can increase their bottom line in the first month. And those with annual sales of £25,000 taken by card payments, will save £500 on transaction fees and 10 hours in reduced management and admin time per month.

The self-employed are key to getting the economy moving again, but the sector was left particularly exposed during Covid.

“For every positive story about a thriving self-employed business or start-up, there is another about someone struggling to survive,” says Nevo. And the struggles are reflected in the statistics.

The number of solo self-employed – sole traders with no employees – in the UK dropped by five percent compared with 2019, including a fall of eight percent in construction and building, 20 percent in road transport and 11 percent in teaching and education professionals. Many have been unable to access benefits such as sick pay, holiday allowance, income protection or mental health support.

“The lack of support has been further highlighted, with up to three million self-employed being unable to claim grants under the Self Employment Income Support Scheme (SEISS). As many as 1.5 million have gone for almost 12 months without financial aid, leading to escalating debt levels.

“It’s incredibly important the self-employed – when they can get back to ‘usual’ operating levels – can maximise the time they spend on customer work. They can’t afford to lose this time to invoice management, chasing late payments or wading through other distracting business admin.”

According to Nevo, more than half of the solo self-employed earn less than £300 a week, compared with just one third of employees.

“This emphasises how important it is that if you’re self-employed you should be able to get paid without it costing you time and money.”

Osu’s head office is in London, while the research and development team is in Tel Aviv. Why target the UK market?

“The UK is the most advanced fintech market in the world. It is at the forefront of Open Banking regulation and has a payment infrastructure that makes offerings like ours possible. This, coupled with the size of the UK market, made it a natural choice for us. “

According to data from the Organisation for Economic Co-operation and Development, the UK ranks towards the top half in terms of the self-employment rate. This position, rather than appearing in the top five or 10, reflects the relative stability of the UK economy versus countries that have very high rates of self-employment such as Colombia and Greece. Israel is not far behind the UK.

But what is “most interesting” says Nevo, “is the very low rate of self-employment in the US. The US is by far the largest market when it comes to absolute numbers and spend on payment and business management tools. As the self-employment rate in the US grows, the growth in absolute numbers is astounding – and it’s why you see so many start-ups going after the US market. For us, the US is a market we would like to serve in the future but, like Israel, there is no Open Banking regulation in place.”

In the meantime, the team is focused on developing the app and introducing new features such as direct communication with customers, calendar integrations, bookings and mini-steps to help users generate an online presence – tools Nevo acknowledges could help see the number of self-employed overtake the number of employed in the next few years.

Thank you for helping to make Jewish News the leading source of news and opinion for the UK Jewish community. Today we're asking for your invaluable help to continue putting our community first in everything we do.

For as little as £5 a month you can help sustain the vital work we do in celebrating and standing up for Jewish life in Britain.

Jewish News holds our community together and keeps us connected. Like a synagogue, it’s where people turn to feel part of something bigger. It also proudly shows the rest of Britain the vibrancy and rich culture of modern Jewish life.

You can make a quick and easy one-off or monthly contribution of £5, £10, £20 or any other sum you’re comfortable with.

100% of your donation will help us continue celebrating our community, in all its dynamic diversity...

Engaging

Being a community platform means so much more than producing a newspaper and website. One of our proudest roles is media partnering with our invaluable charities to amplify the outstanding work they do to help us all.

Celebrating

There’s no shortage of oys in the world but Jewish News takes every opportunity to celebrate the joys too, through projects like Night of Heroes, 40 Under 40 and other compelling countdowns that make the community kvell with pride.

Pioneering

In the first collaboration between media outlets from different faiths, Jewish News worked with British Muslim TV and Church Times to produce a list of young activists leading the way on interfaith understanding.

Campaigning

Royal Mail issued a stamp honouring Holocaust hero Sir Nicholas Winton after a Jewish News campaign attracted more than 100,000 backers. Jewish Newsalso produces special editions of the paper highlighting pressing issues including mental health and Holocaust remembrance.

Easy access

In an age when news is readily accessible, Jewish News provides high-quality content free online and offline, removing any financial barriers to connecting people.

Voice of our community to wider society

The Jewish News team regularly appears on TV, radio and on the pages of the national press to comment on stories about the Jewish community. Easy access to the paper on the streets of London also means Jewish News provides an invaluable window into the community for the country at large.

We hope you agree all this is worth preserving.

- Osu

- Business

- Down to business

- Noam Nevo

- Alon Zion

- Daniel Scott

- Creandum

- Spotify

- Kahoot

- Klarna

- Charles Delingpole

- ComplyAdvantage

- Will Neale

- Grabyo

- Michael Pennington

- Gumtree

- The Boston Consulting Group

- Self Employment Income Support Scheme (SEISS)

- tel aviv

- London

- start-up nation

- Organisation for Economic Co-operation and Development

- Colombia

- greece

- Israel News

-

By Brigit Grant

-

By Laurent Vaughan - Senior Associate (Bishop & Sewell Solicitors)

-

By Laurent Vaughan - Senior Associate (Bishop & Sewell Solicitors)

-

By Laurent Vaughan - Senior Associate (Bishop & Sewell Solicitors)

-

By Laurent Vaughan - Senior Associate (Bishop & Sewell Solicitors)